Stablecoins and Their Role in DeFi

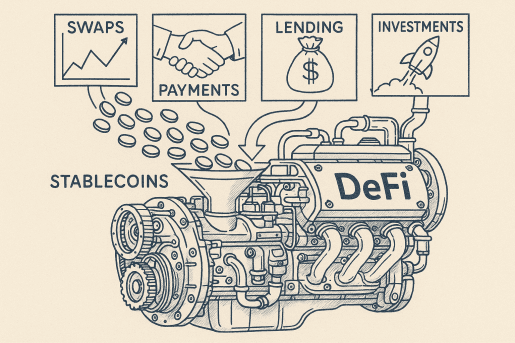

Stablecoins, cryptocurrencies pegged to stable assets like fiat currencies or commodities, are a cornerstone of decentralized finance (DeFi) due to their price stability, making them ideal for various financial applications. Unlike volatile cryptocurrencies such as Bitcoin, stablecoins like USDT, USDC, or DAI maintain consistent value, enabling seamless transactions without the risk of sudden price swings. In DeFi, stablecoins facilitate lending by serving as collateral or loan assets on platforms like Aave or Compound, where users can borrow against or lend stablecoins to earn interest, leveraging smart contracts for trustless, automated processes. They also power payments by offering a reliable medium for cross-border transactions or everyday purchases, with low fees and near-instant settlement compared to traditional banking systems.

In addition, stablecoins are integral to decentralized exchanges (DEXs) for swaps, acting as a stable trading pair that simplifies liquidity provision and reduces slippage in trades on platforms like Uniswap or Curve. For asset management, stablecoins enable users to park funds in low-risk yield farming or staking opportunities, preserving capital while generating returns in DeFi protocols. By providing a predictable store of value, stablecoins bridge traditional finance and DeFi, empowering users to engage in sophisticated financial strategies—lending, payments, swaps, and asset management—without intermediaries, fostering greater financial inclusion and efficiency.

TradFi vs DeFi

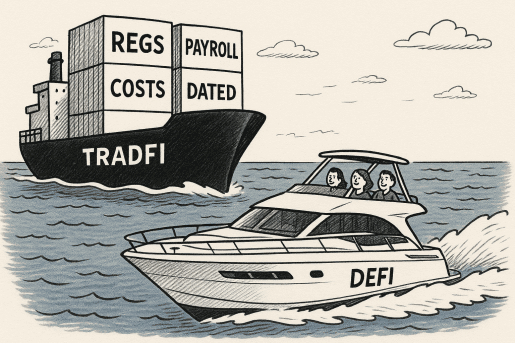

Traditional finance (TradFi) is built on centralized intermediaries—banks, brokers, clearinghouses, and regulators—that manage trust, custody, and transaction settlement. Access is gated through strict requirements like credit checks, KYC/AML compliance, and geographical restrictions. While this provides consumer protections and regulatory oversight, it often comes with high fees, limited transparency, and slower settlement times. In TradFi, users effectively rent access to financial services rather than having direct control over assets, and trust is placed in institutions rather than in code.

Decentralized finance (DeFi), by contrast, removes intermediaries and replaces institutional trust with smart contracts running on blockchains. Anyone with an internet connection and a wallet can access DeFi protocols globally, without traditional barriers to entry. Transactions settle in minutes, liquidity is pooled rather than custodial, and financial products like lending, trading, and derivatives can be composed like “money legos.” However, this openness comes with its own risks: smart contract exploits, volatile yields, governance attacks, and the absence of formal consumer protections. In essence, TradFi prioritizes stability and regulation at the cost of accessibility and efficiency, while DeFi prioritizes openness and programmability at the cost of risk management and institutional trust.

Traditional Banks, such as JP Morgan, Citigroup, Bank of America, Wells Fargo, and more are interested in stablecoins.

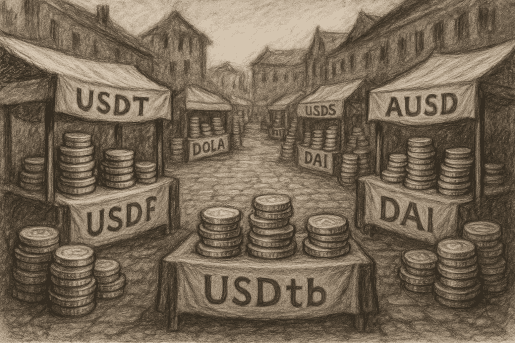

The market is emerging with hundreds of stablecoins, many worth billions of dollars. USDC and USDT lead the space, but many emerging coins such as USDf have innovative features.

The market is truly global accessible via just a mobile phone, from Africa, to the Far East, including Europe, and the USA.

Latest Opinions

Editorial Board • 19 August 2025

Editorial Board • 19 August 2025

Editorial Board • 19 August 2025

Editorial Board • 19 August 2025

Editorial Board • 19 August 2025